Contrary to all the campaign rhetoric from both parties, the government didn’t cause the recession and can’t do a whole lot to fix it. How a mass lapse in character and critical thinking by thousands of executives tanked our economy.

(Originally written in August, 2010 and still relevant today, this article has been revised to reflect new discoveries in 2013.)

As the November election looms, we are faced with a nonstop barrage of commentary about the economy. Of course, the economy is on the top of everyone’s mind so that has put it on the top of politician’s campaign messages. Those trying to unseat an incumbent blast them because the economy has not been fixed or even blame them for the recession. Incumbents claim their programs prevented the economy from getting worse. House Republican leader John Boehner called on President Obama to fire his economic advisors because they have failed to turn the economy around. And so it goes.

There is only one tiny problem with all this political rhetoric. They’re basically wrong. This recession was not caused by anything done by the government in any administration or session of congress whether current or past. And the numbers wouldn’t be any better today even if the other party had been in control. The government didn’t cause the problem and they can’t do a whole lot to solve it.

Any politician that says their approach would be better just doesn’t understand how little the government has to do with economic events like this. The purpose of this article is to explore what caused the recession and what might prevent another one like this. For ideas on how to jump start the economy, please read the article “3 Steps To Boost Jobs And The Economy“.

After tracking all the unfolding events from the moment this economic catastrophe started, I’ve pinpointed what got us into this mess. It turns out thousands of bright, well educated, experienced business people all made the same assumptions at the same time if in fact they were assumptions. It does appear based on the most recent investigative reports in 2013 that many of them knew what was going on and didn’t do anything about it. That’s a lapse in character of the first magnitude.

This reminds me of the story “The Emperors New Clothes” where an entire country believes an assumption to be true when it is clearly false. Until a little boy stands up and questions the assumption. Unfortunately for our economy, the little boy didn’t speak up fast enough and even then, everyone else ignored him.

So what are the assumptions that tanked our economy, who made these assumptions, and how can we prevent others like them from doing it again?

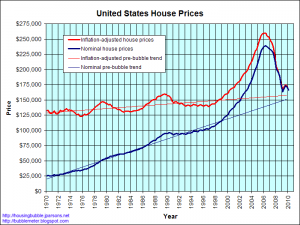

Assumption #1: Real estate prices will always go up

If only the general public believed this, we would never have gotten into this mess. The average person can’t be expected to understand real estate cycles or know when to question trend lines. Even if they saw prices going up and wanted to buy real estate, they wouldn’t have been able to if those in the mortgage and finance industry had avoided this assumption and followed their own lending standards.

We got into this mess primarily because of this assumption. And those who could have stopped the problem before it got out of hand bought it hook, line and sinker. Real estate goes in cycles with prices moving up and down. Those cycles have been tracked and reported for decades. Over all those decades, the pattern was fairly consistent concerning the peaks and troughs. Anyone who had worked for any length of time in the real estate, mortgage, banking, and finance industry knew this.

When real estate demand started forcing prices up higher than the normal trend line, questions should have been raised by thousands of these experts. Why is the cycle not acting as it normally does? Where is this excessive demand coming from? How are so many people getting access to so much mortgage money that they can push up prices like this? What has changed compared to all the previous real estate cycles?

These are fairly basic questions anyone should be asking when a trend breaks out of its normal pattern. On Wall Street, the moment the averages don’t do what they are supposed to do, a million questions are raised and all kinds of analysis follows. But that didn’t happen amongst those lending the money, those handling these real estate transactions and even those on Wall Street who created, rated and insured the financial packages that provided all this extra mortgage money.

The banking and mortgage industry needs to be singled out here. Obviously, they are in the business of making loans because that’s how they make money. As demand rapidly increased for mortgages, they saw the opportunity to make lots and lots of money. And, because of this assumption, they convinced themselves they couldn’t lose even if they dropped their lending standards.

I know what they were telling themselves. “We’re going to make a profit when we make the loan. If the borrower later defaults, we just take the property back and sell it at an even higher price so we make even more money (because real estate prices always rise).” They assumed that rising real estate prices would protect them against anyone who defaulted on their easy money loans. This is akin to believing in the existence of a perpetual money making machine.

Think about all the people who make up this industry especially those in management. Many of them had twenty to thirty years of experience in the industry. They had been through several real estate cycles. They all knew that when real estate prices rise they later come down. Then there are thousands of MBA’s from Harvard, Wharton, Stanford, Anderson and all the rest that fill the ranks of these institutions.

More recent discoveries from court records and new research studies released in late 2012 and early 2013 show that the largest banks deliberately forced through bad loans just to increase their profits. In one court case involving an executive who claimed wrongful discharge due to whistle blowing, it was discovered that Citicorp top management told its loan mortgage defect evaluation unit to limit the number of defective loans to no more than 1% of all loan packages submitted regardless of how many defective loans were submitted.

They did that because every loan that was cleared could be placed in a trust pool and sold as a mortgage backed security. The bank made money when they sold those loans into these investment packages and they also shifted any liability for problem loans to those investors. Since the loans were no longer their responsibility or problem, it didn’t matter if they were really good or not. Questions have been raised as to whether Citicorp has actually eliminated any quota limitations on the discovery of defective loan packages.

The more recent findings add evidence that shows there was clearly a lapse in integrity and character on the part of senior management in major banking and financial institutions. While the banks were called on the carpet about their practices and have had to pay out money in loss mitigation efforts as a result, there does not appear to have been any effort made to address their lapse of character or force a change in culture in the finance industry.

How is it possible that amongst tens of thousands of bright, experienced, educated people in the banking and mortgage industries none of them bothered to question this assumption and inquire about why the real estate market suddenly broke out of its historic pattern? Did all of them see nothing alarming in dropping their lending standards so low? Did none of them feel uneasy that lending volume in dollars was the highest in history and rising at an unprecedented rate? Did they all believe that the economy had magically restructured itself in a new way to support massive lending and real estate price increases with no downside? Why didn’t enough of them speak out publicly about the violations of trust and integrity?

Assumption #2: Mortgage Lenders always follow sound, stable, conservative lending practices

Assumption # 3: Anything secured by real property is always safe.

For the banking and mortgage industry to offer mortgages with their new loosey-goosey lending standards, they needed access to more money to lend…a lot more money. The money had to come from somewhere to fuel this insatiable demand for easy mortgages. Wall Street came to their rescue by boosting the sales of mortgage backed securities (MBS). While these securities had existed since the 1970’s, they were not widely used until much later. For Wall Street, this became a way they could profit more from the booming real estate business. It turned mortgages that used to be held by the institutions that issued them into a bond like security held by investors. The MBS alone would not have created a problem except for the pressure to sell a lot of them to a lot of institutional investors.

The real culprits are firms who rated these securities such as Moody’s and Standard & Poors and the insurance companies who backed them such as AGC. Moody’s and S&P are supposed to be our last line of defense. They are the fail safe component in our economic system. Even if greed blinds everyone else, they are supposed to do their due diligence about the risk level of every security. We trust their ratings. We invest our life savings based on their ratings.

But instead of thoroughly checking out the quality of the real estate loans that these securities were funding, many of the smart, well educated people at Moody’s and S & P assumed that mortgage lenders always follow sound, stable, conservative lending practices. They also assumed that sense these loans were secured by real property, they had to be safe. And that’s how they rated them. So investors bought up these mortgage backed securities based on the ratings and AGC gladly provided the insurance.

Recent emails discovered from the ratings companies show an even worse reality. Apparently, some of their security evaluators saw a problem in the data being used to rate the securities, brought this to the attention of their superiors, and were ignored or reversed.

This situation was made worse by the fact that the Wall Street underwriting companies were paying for securities to be rated that they were going to sell. Those ratings would affect how much money they made and the banks made. The ratings firms didn’t want to displease their customers and lose all that business. One lapse of character after another resulted in thousands of MBS securities receiving an AAA rating when they should have been rated as junk bonds. A bill passed in the Senate to address this problem was sent back to committee by the House where it could die.

It was a house of dominoes built on a few assumptions. A house of dominoes that came tumbling down, sent us into the longest economic downturn since the great depression and can only be fixed by the marketplace cleaning out the debris which tanked millions of people’s jobs and retirement. Until the marketplace cleans out all the bad loans, overpriced real estate, excess real estate inventory, risky securities and everything else that was created by these assumptions, the economy can’t right itself and start chugging along again.

Neither stimulus by the Democrats nor tax and regulatory cuts by the Republicans address what caused this to occur. The marketplace has to clean up its own mess. While businesses always talk about wanting lower taxes and less regulation, the truth is that as long as a business can increase its net profits, it will do so even if it has to pay higher taxes. That’s because even if you apply a higher tax rate to profits, you are still left with more money after taxes than you were before you invested in the expansion. This is what economist don’t understand about how real business decisions are made.

How Can We Prevent This From Happening Again?

Which leaves us with the question…how can we prevent this from happening again? A free market will always experience economic cycles of expansion and contraction. We have gone through many recessions during the last few decades that were caused by normal forces. So no, we can’t prevent recessions. But what happened here was not caused by normal economic forces and the downturn that resulted has turned out to be anything but normal.

This entire economic nightmare was caused by bad thinking, or rather, the absence of critical thinking along with poor character and ethics. What burns me up is that this lapse in critical thinking occurred on the part of tens of thousands of experienced business people and MBA’s. How could this many bright, experienced, well educated people all make the same disastrous assumptions….assumptions that defy common sense and economic history.

Just what are they teaching in all these MBA programs that their bright students can go out into the business world and all fail to question what is going on when the trend lines first get out of whack? I know the case studies they use teach them to identify issues just like this so why can’t they apply what they learn in the real world? How can so many experienced bankers and mortgage lenders all have a sudden lapse of memory about what happens to real estate prices? How is it possible for Moody’s and S&P to rate a security without doing their due diligence?

As I have been telling my clients for over 25 years, “it’s all about thinking” which is also the title of one of my Insights Into Success articles. Believe me, if everyone had been religiously following the thinking processes mentioned in that article, this recession wouldn’t have happened. Of course, that also assumes there were enough people to act with character when the truth was discovered. We have clearly seen a massive lapse of character, integrity and ethics on the part of too many senior level managers.

While this recession was caused by the banking and finance industry, the next brain and character lapse could come from an entirely different industry. Recessions are all about the flow of money. Any large industry that can affect the flow of money throughout large portions of our society have the potential to tank the economy (did I just hear someone yell out Internet???).

So what’s my professional recommendation to prevent this type of brain lapse in the future? We need to put every executive, manager and technical staff expert in every industry in America through an intensive refresher course in critical thinking and character-based leadership. That’s right. Everyone including Chairman of the Boards and CEO’s all need to be taught critical thinking and the importance of doing the right thing. We can’t assume that they are excellent critical thinkers because of their job titles and responsibility. We can’t assume they will lead with character simply because of their prestigious positions. We already made that assumption once and look where it got us. Avoiding assumptions is the only thing that will prevent another one.

Blog: When Your Character Leads The Charge, Everyone Owns The Goal

Blog: Build Trust to Boost Employee Retention and Customer Service

To Schedule Don Shapiro for an Interview or Appearance

About Don Shapiro

Don Shapiro is the co-author and editor of The Character-Based Leader and President of First Concepts Consultants, Inc. For 28 years, he has worked with for profit and non-profit organizations in over 30 industries to discover ways to grow and operate better based on his original research on how we make and influence choices. Don is an inspiring speaker on leadership, selling, strategy and choices. He is a graduate of the Executive Program in Management at the UCLA Anderson School of Management.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

July 28, 2012 @ 1:19 pm

Hey Don,

Great article, just thought I’de let you know I enjoyed the read and actually referenced it in my latest blog post 🙂

Have a great weekend,

Alex B.

Three Steps Toward Job Growth and Economic Recovery | First Concepts Consultants, Inc.

August 4, 2013 @ 2:58 pm

[…] the economy, contrary to all the pronouncements by politicians running for office. There are many assumptions that tanked the economy, but the true explanations are elusive. But the path to economic recovery is out there—targeted […]

June 10, 2014 @ 11:53 pm

) and works by turning sonic vibrations into heat over time and distance.

They arrive with designed in amplifiers to give you the ideal sounds.

Once they are aware of the problem, they may start to walk around their

apartment in stocking feet.

Lead Change Group | A Leadership Crisis In My Own Business

October 8, 2014 @ 4:57 am

[…] first two blogs on there are titled “3 Steps to Boost Jobs and Economy” and the other is “The Assumptions That Tanked The Economy.” Politicians from both parties will not like what I have to say. Banking, finance and mortgage […]